Whether it’s the dream of owning a home often necessitates financial support in the form of a home loan . Amidst the plethora of financial terms and considerations, understanding the correlation between CTC (Cost To Company) and home loans is crucial. Let’s understand how CTC influences the home loan process and what factors borrowers need to consider.

Part from CTC in home Mortgage Qualifications

Earnings Testing : Lenders see borrowers’ qualification to own home loans predicated on its earnings. CTC serves as a pivotal metric within testing, providing information into the borrower’s making potential and you can financial balance.

Debt-to-Money Proportion (DTI): Loan providers think about the borrower’s DTI ratio, and this measures up its total monthly obligations repayments to their disgusting month-to-month income. CTC forms the foundation associated with the calculation, whilst means this new borrower’s overall income.

Loan amount Computation: The most amount borrowed a debtor qualifies to possess relies on their earnings, having CTC becoming a primary determinant. Lenders typically offer loans based on a particular portion of the fresh borrower’s money, making sure brand new monthly payments will always be affordable.

Perception from CTC Parts for the Mortgage Approval

First Paycheck : Loan providers have a tendency to focus on the borrower’s earliest income whenever assessing its cost skill. A higher earliest salary means a stronger monetary position and might improve the probability of mortgage approval.

Allowances and you can installment loans in Arizona Bonuses : If you find yourself allowances and you may bonuses subscribe the fresh new CTC, loan providers could possibly get scrutinise these areas in a different way. Regular and you will guaranteed allowances are usually felt way more favorably than simply varying incentives, while they offer a reliable revenue stream to have loan costs.

Stability and you will Surface : Loan providers like consumers that have a constant and you will uniform money stream, because helps to control default. People with fluctuating CTC components could need to render a lot more files or demonstrate a routine money record in order to safe loan approval.

Optimising CTC for Mortgage Approval

Paycheck Build : Borrowers can strategically build their paycheck elements to compliment its qualification to have lenders. Improving the proportion of first paycheck in accordance with allowances and you may incentives normally strengthen the installment capabilities regarding the vision away from loan providers.

Files Confirmation : Guaranteeing perfect and you will full paperwork of CTC parts is essential through the our home loan application procedure. Lenders may consult proof of earnings, particularly salary slides, tax productivity, and you can a position agreements, to ensure this new borrower’s financial background.

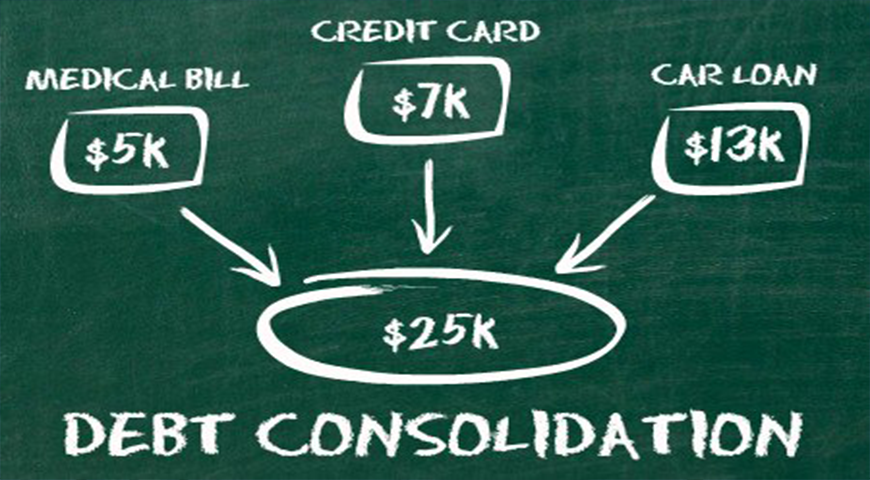

Financial obligation Management : Handling present debts and you can obligations is crucial for keeping an excellent DTI proportion and you will improving mortgage qualifications. Borrowers would be to try to reduce an excellent bills and get away from taking up the latest obligations in advance of obtaining a home loan.

Real-Lives Application: Navigating Financial Acceptance which have CTC

Check out the scenario of Rohan, who wishes to get 1st household. Rohan’s CTC comes with a hefty very first income and varying incentives and you can allowances. To enhance his financial eligibility, Rohan decides to negotiate together with his workplace to improve their first paycheck while keeping an aggressive overall CTC.

Upon obtaining home financing, Rohan will bring total files away from his earnings, also income slides and taxation statements. His secure money history and you will smartly structured CTC components impress the new lender, resulting in quick acceptance out of their home loan app.

Conclusion

CTC takes on a crucial role within the determining your qualification to own mortgage brokers by giving information into their money and you will financial balance. Focusing on how CTC affects the house mortgage process allows borrowers so you’re able to optimize their monetary profile and you will boost their possibility of mortgage approval. Of the strategically dealing with its paycheck section, recording the money accurately, and you may maintaining a healthier loans-to-income ratio, some body can navigate the fresh intricacies from mortgage acceptance confidently and you will success.

Really, CTC functions as a thorough construction to have researching and you may facts a keen employee’s overall settlement package. By deciphering their definition and you can examining their important factors, someone renders informed choices away from work now offers, paycheck negotiations, and you may financial planning. Understanding the subtleties from CTC empowers team in order to browse the fresh new cutting-edge landscape out-of corporate compensation with certainty and you will quality.

Online Order

Online Order